from Straffi & Straffi Attorneys at Law https://www.northjersey.com/story/sports/high-school/football/2023/09/30/st-joseph-football-rolls-past-donovan-catholic-behind-strong-offense/70990334007/

Saturday, September 30, 2023

St. Joseph football rolls past Donovan Catholic to set up battle for No. 1

from Straffi & Straffi Attorneys at Law https://www.northjersey.com/story/sports/high-school/football/2023/09/30/st-joseph-football-rolls-past-donovan-catholic-behind-strong-offense/70990334007/

Friday, September 29, 2023

Flooding rains submerge cars, snarl Jersey Shore traffic

from Straffi & Straffi Attorneys at Law https://www.app.com/story/weather/stormwatch/2023/09/29/nj-weather-downpours-cause-flooding-snarl-jersey-shore-traffic/71003961007/

Andy Kim shows momentum in first week as U.S. Senate candidate

from Straffi & Straffi Attorneys at Law https://newjerseyglobe.com/congress/andy-kim-shows-momentum-in-first-week-as-u-s-senate-candidate/

See How Veterans Services Might Be Affected By Government Shutdown

from Straffi & Straffi Attorneys at Law https://patch.com/new-jersey/tomsriver/see-how-veterans-services-might-be-affected-government-shutdown

Can My Medical Debt Be Paid Off With Bankruptcy?

With the US having one of the highest costs of healthcare in the world, it comes as little surprise that most Americans carry exorbitant amounts of medical debt. In 2019, the average cost of healthcare in the United States was $11,462. In 2022, this figure rose to $12,530. At the end of 2019, research by the Kaiser Family Foundation estimates that the total medical debt in the US has reached at least $195 billion, with the figure expected to rise to account for debt incurred during the Covid-19 pandemic. Each year in the US, 650,000 people file bankruptcy due to medical debt.

These figures do not account for other financial obligations a person can have, like utility bills, rent, and the cost of education, even without having to deal with illnesses or injuries. Facing such financial struggles can leave a person feeling helpless.

Bankruptcy can offer a level of protection and allow you to recollect yourself and gather your resources in the interest of a fresh start. An experienced New Jersey bankruptcy attorney may be able to help you explore your options for seeking relief from debt and guide you through the process. If you’re wondering about bankruptcy filing frequency in New Jersey, our top-rated New Jersey bankruptcy attorneys at Straffi & Straffi Attorneys-at-Law can provide you with skilled legal counsel and help you navigate the process of filing for bankruptcy. Call us today at (732) 341-3800 to schedule a complimentary consultation.

Medical Debt in the US

The demographics of American medical debt show that middle-aged Americans are more likely to have significant medical debt or medical debt amounting to more than $1,000. More than 23 million adults owe over $1,000 in medical debt and about 11 million owe over $2,000.

According to a survey by Kaiser Family Foundation, one in five people who had medical debt have been contacted by collection agencies and 9% stated that they have filed for personal bankruptcy due to medical expenses. The 2019 data also shows that 3 million or 13% of American adults report having debt of more than $10,000.

A 2009 study published in the American Journal of Medicine claims that 62.1% of all bankruptcies in the US were caused by medical bills. The study clarified that it included the following in the distinction of what they considered as debts due to medical causes:

- People who mortgaged their homes to pay off medical bills

- People who had medical bills greater than $1,000

- People who were unable to go to work for at least 2 weeks due to an illness

This figure only increased in 2019, with 66.5% of bankruptcies being filed due to medical debt.

One out of 10 adults has some form of medical debt with the uninsured being one of the demographics hit the most. Those with medical insurance are not spared from debt, however. Despite over 90% of the US population having some sort of medical insurance, a quarter of adults with medical debt owe above $5,000.

Most people with large consumer debt either seek loans from family members or face the threat of their homes being foreclosed. The risk of medical debt only increases as the need for medical care also grows as we get older. As such, it may seem increasingly difficult to get relief from debt. One in five adults with medical debt, regardless of the amount, say they don’t expect to ever be able to pay their debt off.

While there is no easy way of obtaining debt relief, there are other options available that you can explore to discharge your debt. One of which is filing for bankruptcy.

NJ Statute Of Limitations On Medical Debt

When facing difficulties in resolving a debt and it eventually falls into default, it is crucial to be aware of the potential consequences that may follow. In the state of New Jersey, many consumers are unaware of the existence of a legal timeframe within which creditors or debt collectors can pursue outstanding debts. This timeframe is known as the statute of limitations. Once this legal timeframe has expired, individuals are no longer vulnerable to legal actions concerning that particular debt.

In New Jersey, the statute of limitations for medical debt is set at six years. This means that if there has been no account activity for a period of six years or more, creditors and debt collectors are prohibited from filing a lawsuit against you to collect that debt. If you are facing a debt lawsuit in New Jersey, it is crucial to respond within 35 days to prevent a default judgment from being issued against you.

Navigating the intricacies of the New Jersey statute of limitations on medical debt can be overwhelming, but a skilled New Jersey bankruptcy attorney can guide you through the process. At Straffi & Straffi Attorneys at Law, our attorneys can assist you in navigating the complexities of medical debt and can provide tailored solutions to help you regain financial stability. We can help you find effective solutions to your financial challenges. Whether you’re facing medical debt or other financial difficulties, we can provide the guidance and support you need. Contact us today to schedule a consultation and take the first step towards a brighter financial future.

How Can Bankruptcy Get Rid of Medical Debt?

There are many different kinds of bankruptcy available depending on either the financial situation or the kind of entity (whether a person, a business, or a corporation) filing for bankruptcy. However, to understand bankruptcy, we must first understand the kind of debt that needs to be relieved.

There are two types of consumer debt, secured and unsecured. Secured debt typically refers to debt that has collateral serving as security against non-repayment of the loan. Unsecured debt is issued to debtors depending on the creditworthiness of a debtor. Due to the existence of the collateral for secured debt, there is less risk of the debtor defaulting on the debt.

The most common types of secured debt are mortgages and car loans while unsecured debt is commonly encountered as credit card debt. Medical debt falls under the category of unsecured debt.

Which debts would be relieved and how would depend on the type of bankruptcy you choose and which is more applicable to your situation. While there is no specific type of bankruptcy that applies to medical debt, most unsecured debt is typically discharged or relieved when the bankruptcy is finalized. The two most common types of personal bankruptcy availed by those with medical debt are Chapter 7 and Chapter 13 bankruptcy.

Chapter 7 Bankruptcy

Chapter 7 Bankruptcy is commonly referred to as liquidation bankruptcy. Filing for Chapter 7 bankruptcy automatically stays any collection efforts by creditors, threats of foreclosure, and any lawsuits filed against the debtor.

In a Chapter 7 bankruptcy, the debtor’s non-exempt assets are liquidated to pay off all or part of their debts. The Bankruptcy Court assigns a trustee who will deal with your creditors on your behalf and who will collect resources through the sale of your assets. Most unsecured debts, including medical debts, are discharged in a Chapter 7 bankruptcy. However, debts like alimony, child support, taxes, and student loans cannot be discharged unless in special circumstances.

Petitioners who want to apply for a Chapter 7 bankruptcy need to pass a means test and must typically have little or no assets in order to qualify. This is to avoid abuse of the system and ensure that the debtor is not abusing the law to avoid paying debts they can actually afford to pay.

Exempt assets in a liquidation bankruptcy include a primary residence, any tools a person needs to make their living, personal possessions (valued up to a certain amount), and a car (provided that it is not in equity). Assets like a vacation home, jewelry, or assets that are not considered necessary for living will be sold off to recoup some funds to pay off creditors.

Aside from the means test, the debtor must compile all the necessary information and the Official Bankruptcy Form and submit the petition to the Bankruptcy Court. The information must also include the following details:

- A list of their creditors and how much the debtor owes each one

- The debtor’s source and amount of income

- An inventory of all of the debtor’s property

- A list of their monthly living expenses

In New Jersey, the means test involves taking your average household income for the last six months and comparing it to the median income of households of a similar size in the state. If your household income is lower than the threshold, then you may proceed with filing for a Chapter 7 bankruptcy.

If you cannot meet the requirements of the means test, the Bankruptcy Court may take a closer look at your expenses and income. From this, it can either deny your petition or convert it to a Chapter 13 Bankruptcy if you can still qualify for bankruptcy but have enough disposable income to pay off your debts.

To ensure the best possible chances of your bankruptcy petition being approved by the court, you should consider getting the help of an experienced New Jersey bankruptcy attorney to help you gather the necessary information and guide you through the process.

Chapter 13 Bankruptcy

A Chapter 13 bankruptcy, also referred to as a “wage earner’s plan”, is concerned with creating a repayment plan with the goal of reorganizing the debtor’s finances and allowing the debtor to pay off their debt in the span of 3 to 5 years. The repayment plan is meant to allow the creditors to be paid what they would have been paid if a different chapter of bankruptcy had been filed. A Chapter 13 bankruptcy may require the debtor to use 100% of their disposable income to repay their debts as determined by the court.

Unlike a Chapter 7 bankruptcy, Chapter 13 does not require passing a means test in order to qualify. New Jersey allows debtors with a combined debt limit of up to $2.75 million in secured and unsecured debts to apply for Chapter 13. Filing for a Chapter 13 bankruptcy also gives a stay on collection efforts by creditors and any threats of foreclosure.

However, compared to a Chapter 7 bankruptcy where the Bankruptcy Trustee’s responsibility is to act as a mediator and liquidate the debtor’s assets, the trustee’s duty in Chapter 13 is only to collect the debtor’s monthly payments.

Despite there being no debts actually discharged in a Chapter 13 bankruptcy, a debtor will be able to keep their assets in a Chapter 13 bankruptcy as long as they can keep up with the monthly payments.

While not all unsecured medical debt will be discharged in a Chapter 13 bankruptcy, it can be seen as a better alternative for debtors who see remortgaging their primary residence as their only way to pay off medical debt. A Chapter 13 bankruptcy allows debtors to find other sources of income and repay their debts without collection agencies hounding them.

| Bankruptcy Type | Effect on Medical Debt | Means Test Required |

|---|---|---|

| Chapter 7 | Most unsecured medical debt can be discharged | Yes, to qualify |

| Chapter 13 | Not discharged, but can be included in a repayment plan | No |

Credit Counseling and Debtor Education

Before you can file your petition for bankruptcy, you will be required to attend two mandatory credit counseling courses. The first class involves credit counseling and aims to help debtors determine whether filing for bankruptcy is the right course of action for their specific financial situation. Once the petition has been filed, the second required course tackles debtor education. The goal of debtor education is to equip bankruptcy petitioners with the tools they need to manage their finances after their bankruptcy is over.

Bankruptcy and Medical Bills

Bankruptcy can provide a safeguard and enable individuals to regroup and gather resources for a new beginning. Medical debt, classified as unsecured debt, can be resolved through bankruptcy. The two primary types of personal bankruptcy available for individuals with medical debt are Chapter 7 and Chapter 13 bankruptcy.

Chapter 7 bankruptcy, also referred to as liquidation bankruptcy, requires the liquidation of the debtor’s non-exempt assets to pay off some or all of their debts. In Chapter 7 bankruptcy, most unsecured debts, including medical debts, are discharged. However, debts such as alimony, child support, taxes, and student loans are not dischargeable unless under special circumstances. To qualify for Chapter 7 bankruptcy, applicants must pass a means test and generally possess minimal to no assets.

Chapter 13 bankruptcy, also called the “wage earner’s plan,” focuses on creating a repayment plan that reorganizes the debtor’s finances, allowing them to pay off their debt over a period of 3 to 5 years. Although not all unsecured medical debt is dischargeable under Chapter 13 bankruptcy, it may be a preferable alternative for debtors who view remortgaging their primary residence as their only option for repaying medical debt.

Before deciding to file for bankruptcy, it is critical to weigh all available options and seek the advice of an experienced bankruptcy lawyer. They can assess your financial situation and recommend the most appropriate course of action. Alternative solutions to bankruptcy, such as debt negotiations, loan term modifications, or obtaining discounts for paying off medical debt in full, may provide immediate relief but may only be temporary solutions.

Other Options for Repaying Medical Debt

Filing for bankruptcy is a decision that you should make only after considering all of your available options. Other alternatives to filing bankruptcy can include the following:

- Debt negotiations

- Modifying the terms of your loan

- Getting discounts for paying the medical debt in full

- Paying off your debt with credit cards or other unsecured credit

However, it should be noted that while these options can provide immediate relief and can work for some debtors, such as paying off medical debt using credit cards, they may only work as a band-aid solution and can lead to more debt.

Most people who file for bankruptcy do so because they want to avoid the pressure of having to deal with debt collectors and lawsuits from creditors. While bankruptcy is often used to discharge debt, some debtors see it as a way to allow themselves breathing room and more time to get on their feet and pay their debt. Before you make any decision, speaking with a skilled attorney who can explain your options is beneficial.

Working With an Experienced New Jersey Bankruptcy Attorney

Considering the right course of action is difficult when faced with great medical debt. The relief from debt that bankruptcy offers has a caveat, specifically, a great impact on your credit score. With the help of a qualified New Jersey bankruptcy attorney, you may be able to lessen the blow and determine your best strategy when filing for bankruptcy. A good attorney should be able to examine your financial situation and weigh your options on whether filing for bankruptcy is the right option for you.

At Straffi and Straffi Attorneys At Law, our skilled bankruptcy attorneys have dedicated their practice to providing quality legal services to New Jersey residents. If you are facing financial difficulties and are unsure of how to proceed in seeking relief from debt, we may be able to help guide you through the process of filing a Chapter 7 or Chapter 13 bankruptcy. To learn more about how we can help and to schedule a free consultation with one of our attorneys, contact us today at (732) 341-3800 or fill out our online form.

from Straffi & Straffi Attorneys at Law https://www.straffilaw.com/can-my-medical-debt-be-paid-off-with-bankruptcy/

It's National Coffee Day! Here's Where To Get Yours In NJ Today

from Straffi & Straffi Attorneys at Law https://catcountry1073.com/national-coffe-day-new-jersey-2023/

Blue Friday: Off-duty cop reacts, saves lives

from Straffi & Straffi Attorneys at Law https://nj1015.com/blue-friday-off-duty-cop-reacts-saves-lives/

Discover (and save!) your own Pins on Pinterest.

from Straffi & Straffi Attorneys at Law https://www.pinterest.com/pin/1097400634188237269/

Discover (and save!) your own Pins on Pinterest.

from Straffi & Straffi Attorneys at Law https://www.pinterest.com/pin/1097400634188236700/

Thursday, September 28, 2023

Lakewood carjacking suspect arrested at hotel

from Straffi & Straffi Attorneys at Law https://www.app.com/story/news/crime/2023/09/28/carjacking-suspect-found-at-lakewood-hotel-cops-say/70992305007/

Chowderfest Returns: This Weekend In Ocean County

from Straffi & Straffi Attorneys at Law https://patch.com/new-jersey/berkeley-nj/chowderfest-returns-weekend-ocean-county

Little Egg Harbor Man Killed In Route 37 Crash: Police

from Straffi & Straffi Attorneys at Law https://patch.com/new-jersey/barnegat-manahawkin/little-egg-harbor-man-killed-route-37-crash-police

Shore Conference football notebook: A huge SJ2 game & key stories ahead of Week 5

from Straffi & Straffi Attorneys at Law https://www.nj.com/highschoolsports/2023/09/shore-conference-football-notebook-huge-sj2-game-key-stories-ahead-of-week-5.html

Jersey Shore Most Influential 2024 — Politics: George Gilmore’s path back to NJ kingmaker

from Straffi & Straffi Attorneys at Law https://www.app.com/story/news/politics/2023/09/28/george-gilmore-new-jersey-influencer-vin-gopal-democrats-republicans/70606239007/

COVID mask mandates: Three Monmouth and Ocean County hospitals bring them back

from Straffi & Straffi Attorneys at Law https://www.app.com/story/news/health/2023/09/28/covid-mask-mandates-return-jersey-shore-hospitals/70979016007/

Wednesday, September 27, 2023

Social Services Goes Mobile Across Ocean County

from Straffi & Straffi Attorneys at Law https://www.jerseyshoreonline.com/ocean-county/social-services-goes-mobile-across-ocean-county/

Red Meat Wednesday: The best burgers in NJ

from Straffi & Straffi Attorneys at Law https://nj1015.com/red-meat-wednesday-the-best-burgers-in-nj/

WOW, 42 Amazing Pictures of Then and Now in Toms River, NJ

from Straffi & Straffi Attorneys at Law https://wobm.com/wow-42-amazing-pictures-of-then-and-now-in-toms-river-nj/

Spend a Suspenseful Hour with Ruth Ware In Ocean County Library's Virtual Author Talk Series

from Straffi & Straffi Attorneys at Law https://www.newjerseystage.com/articles/getarticle2.php?titlelink=spend-a-suspenseful-hour-with-ruth-ware-in-ocean-county-librarys-virtual-author-talk-series092023

Widow’s Claims Don’t Match Evidence

from Straffi & Straffi Attorneys at Law https://www.thesandpaper.net/articles/widows-claims-dont-match-evidence/

Lakewood schools borrowed millions from New Jersey and still can't pay its bills

from Straffi & Straffi Attorneys at Law https://www.app.com/story/news/local/jackson-lakewood/lakewood/2023/09/27/lakewood-nj-schools-private-public-new-jersey-education-funding/70410314007/

Jersey Shore Most Influential 2024 — Sports: Vinny Curry rushes to help Neptune NJ kids

from Straffi & Straffi Attorneys at Law https://www.app.com/story/sports/2023/09/27/vinny-curry-new-jersey-influencer-steve-antonucci-nj-high-school-sports/70538293007/

Tuesday, September 26, 2023

Lacy Township Man Sentenced to Six Years in State Prison for Manslaughter

from Straffi & Straffi Attorneys at Law https://midjersey.news/2023/09/26/lacy-township-man-sentenced-to-six-years-in-state-prison-for-manslaughter/

Events This Week in New Jersey: September 26 to October 2, 2023

from Straffi & Straffi Attorneys at Law https://www.newjerseystage.com/articles/getarticle2.php?titlelink=events-this-week-in-new-jersey-september-26-to-october-2-2023092023

This Week in Theatre: Previews for Plays Taking Place September 26 to October 2, 2023

from Straffi & Straffi Attorneys at Law https://www.newjerseystage.com/articles/getarticle2.php?titlelink=this-week-in-theatre-previews-for-plays-taking-place-september-26-to-october-2-2023092023

Top 27 rain totals in N.J. from Tropical Storm Ophelia

from Straffi & Straffi Attorneys at Law https://www.nj.com/weather/2023/09/nj-weather-top-27-rain-totals-from-tropical-storm-ophelia.html

Menendez's strange banking habits

from Straffi & Straffi Attorneys at Law https://www.politico.com/newsletters/new-jersey-playbook/2023/09/26/menendezs-strange-banking-habits-00118084

Drug Dealer Gets Six Years for Toms River Deadly Overdose

from Straffi & Straffi Attorneys at Law https://www.shorenewsnetwork.com/2023/09/26/drug-dealer-gets-six-years-for-toms-river-deadly-overdose/

Monday, September 25, 2023

Brick Township Estate Planning Attorney Christine Matus Announces Expansion of Service Area in Brick Township

from Straffi & Straffi Attorneys at Law https://www.benzinga.com/pressreleases/23/09/ab34883762/brick-township-estate-planning-attorney-christine-matus-announces-expansion-of-service-area-in-br

How Much Rain Did Ophelia Bring To Toms River? See The Totals

from Straffi & Straffi Attorneys at Law https://patch.com/new-jersey/tomsriver/how-much-rain-did-ophelia-bring-toms-river-see-totals

LACEY TOWNSHIP MAN SENTENCED TO STATE PRISON FOR MANSLAUGHTER

from Straffi & Straffi Attorneys at Law https://ocponj.gov/lacey-township-man-sentenced-to-state-prison-for-manslaughter/

Ava White of Jackson Memorial is the WOBM/Gateway Toyota Student of the Week

from Straffi & Straffi Attorneys at Law https://wobm.com/jacksons-ava-white-is-the-student-of-the-week/

Monday NJ weather: More on-and-off rain, wind kicks up again

from Straffi & Straffi Attorneys at Law https://nj1015.com/monday-nj-weather-more-on-and-off-rain-wind-kicks-up-again/

ACY Airport broke a daily rainfall record Saturday, it tripled the previous mark

from Straffi & Straffi Attorneys at Law https://pressofatlanticcity.com/news/local/weather/south-jersey-rainfall-record-broken-ophelia/article_73b85208-5acf-11ee-922b-573c64c43024.html

Sunday, September 24, 2023

NJ school elections: construction projects and a possible merger

from Straffi & Straffi Attorneys at Law https://nj1015.com/nj-special-school-elections/

N.J. weather: See rainfall totals from Tropical Storm Ophelia

from Straffi & Straffi Attorneys at Law https://www.nj.com/weather/2023/09/nj-weather-see-rainfall-totals-from-tropical-storm-ophelia.html

Saturday, September 23, 2023

Get Travel Tips from Rick Steves in Ocean County Library's Virtual Author Talk Series

from Straffi & Straffi Attorneys at Law https://www.newjerseystage.com/articles/getarticle2.php?titlelink=get-travel-tips-from-rick-steves-in-ocean-county-librarys-virtual-author-talk-series092023

High winds could delay Opheila power restoration efforts in NJ

from Straffi & Straffi Attorneys at Law https://nj1015.com/high-winds-could-delay-opheila-power-restoration-efforts-in-nj/

Friday, September 22, 2023

2 Barnegat Teens Beat Man In Bathroom, Steal His Car: Police

from Straffi & Straffi Attorneys at Law https://patch.com/new-jersey/barnegat-manahawkin/2-barnegat-teens-beat-man-bathroom-steal-his-car-police

Ex-Ocean Gate mayor pleads guilty to ‘pattern of official misconduct;’ jailtime expected

from Straffi & Straffi Attorneys at Law https://www.app.com/story/news/local/ocean-county/2023/09/22/former-ocean-gate-nj-mayor-pleads-guilty-to-official-misconduct/70934661007/

Gov’t auctions, parking meter revenue. Former N.J. mayor admits pocketing town’s money.

from Straffi & Straffi Attorneys at Law https://www.nj.com/ocean/2023/09/govt-auctions-parking-meter-coins-former-nj-mayor-admits-pocketing-towns-money.html

Man Beaten In Toms River Restaurant Restroom, Car Stolen: Police

from Straffi & Straffi Attorneys at Law https://patch.com/new-jersey/tomsriver/man-beaten-toms-river-riiestaurant-restroom-car-stolen-police

Toms River Man Charged After Homeowner Sees Break-In In Progress: PD

from Straffi & Straffi Attorneys at Law https://patch.com/new-jersey/tomsriver/toms-river-man-charged-after-homeowner-sees-break-progress-pd

Somerset Man In Ski-Mask Among 2 Arrested, Gun Seized In Brick: Police

from Straffi & Straffi Attorneys at Law https://patch.com/new-jersey/hillsborough/somerset-man-ski-mask-among-2-arrested-gun-seized-brick

Suspects In Ski Masks Arrested With Weapons In Brick Township: Police

from Straffi & Straffi Attorneys at Law https://dailyvoice.com/new-jersey/ocean/suspects-in-ski-masks-arrested-with-weapons-in-brick-township-police/

Girls Top 20 for Sept. 22: Big changes as more teams enter the fray

from Straffi & Straffi Attorneys at Law https://www.nj.com/highschoolsports/2023/09/girls-top-20-for-sept-22-big-changes-as-more-teams-enter-the-fray.html

The Menendez news keeps getting worse

from Straffi & Straffi Attorneys at Law https://www.politico.com/newsletters/new-jersey-playbook/2023/09/22/the-menendez-news-keeps-getting-worse-00117526

Thursday, September 21, 2023

Coastal Flood Watch, High Wind Warning Issued For Ocean County

from Straffi & Straffi Attorneys at Law https://patch.com/new-jersey/tomsriver/coastal-flood-watch-high-wind-warning-issued-ocean-county

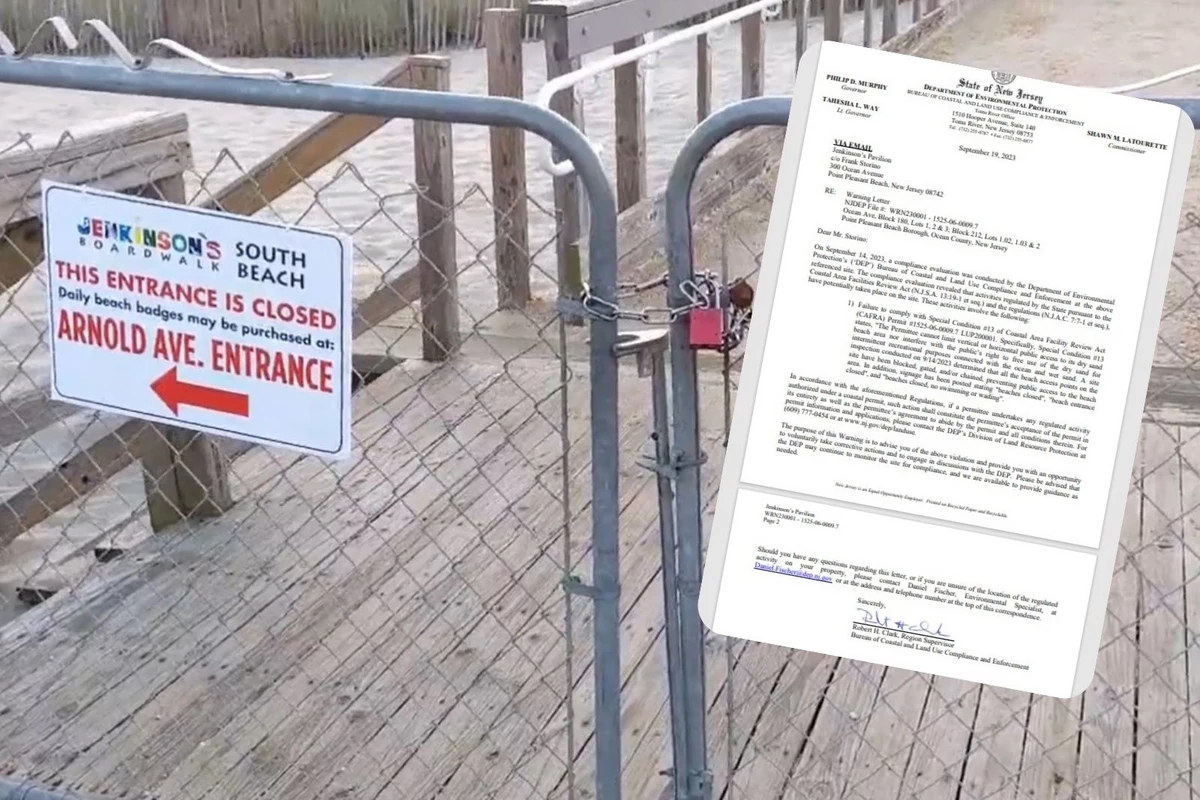

Jenkinson's defies New Jersey by banning public from beach

from Straffi & Straffi Attorneys at Law https://nj1015.com/jenkinsons-defies-new-jersey-by-banning-public-from-beach/

More districts reject Murphy's trans policy in NJ schools

from Straffi & Straffi Attorneys at Law https://nj1015.com/colts-neck-and-howell-reject-murphys-trans-policy-in-nj-schools/

The Fantastic Greek Festival Is This Weekend in Toms River, New Jersey

from Straffi & Straffi Attorneys at Law https://wobm.com/the-fantastic-greek-festival-is-this-weekend-in-toms-river-new-jersey/